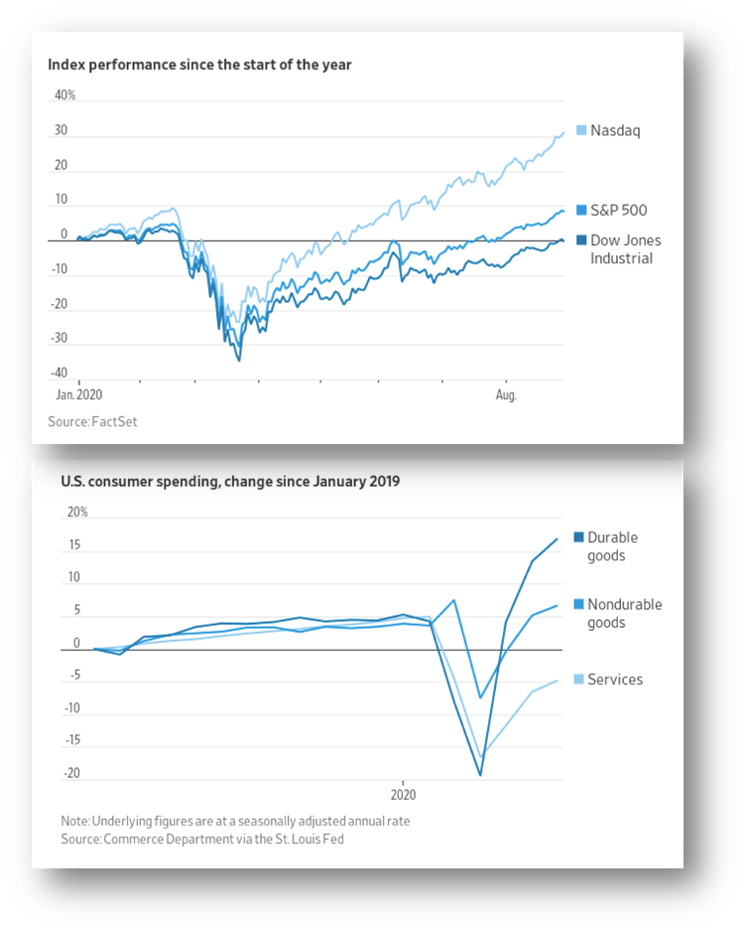

Major domestic stock show volatile trading

• Tech-heavy Nasdaq fared worst down 10% from all time high Sept 2.

• Energy shares still weak as crude oil prices fall below $40 per barrel due to Saudi Arabia cutting oil prices

Inflation data surprised on the upside

with both core and headline consumer prices rising 0.4% from July.

- Used Car prices largest gains in 5 decades as American shunned public transportation.

- J Crew Group – one of the first retailers to file bankruptcy due to the pandemic – emerged from bankruptcy after completing it’s restructure plan.

Longer-term U.S. Treasury yields decreased

on growing COVID 19 concerns. It briefly slid to levels last seen in late April, aided by strong auction demand for 10-year U.S. Treasury notes & 30-year U.S. Treasury bonds.

European stocks rise on continued economic recovery, shaking off disappointment the ECB didn’t announce additional stimulus. Pan-European STOXX Europe 600 up 1.6%; Germany’s DAX rose 2.80%; France’s CAC 40 rose 1.39%; Italy’s FTSE MIB 2.21%; and UK’s FTSE 100 up 4.02%.

Chinese A shares down 3%.

Fueled by news the Trump Administration was considering adding SMIC, China’s top chip foundry, to a list of U.S. sanctioned companies dealt a blow to sentiment.

Japan, stocks showed modest gains from previous week.

1.4 million US jobs added in August and the unemployment rate fell to 8.4 %

— below 10 percent for the first time since the pandemic hit.

Morning Consult economist John Leer says the U.S. workforce is splitting into two groups:

- Those with a job, who are more and more confident they’ll keep it

- Those who have been furloughed or fired are increasingly worried they'll get locked out of the labor force altogether.

Overall consumer spending remained 4.6 percent below pre-pandemic level.

The hidden cost of remote school:

Parents quitting work to stay home with their children, a potential blow to the economy that could be big enough to rival a small or medium-size recession.

Retirement How long will I live? Investors frequently underestimate the number of years they will likely live and may fail to plan accordingly, states a new study from Morningstar.

A number of variables such as gender, income, household health, and smoking factor into longevity, the study finds even those who feel they’ll be around for 20 or 30 years after retirement may be underestimating their longevity — and not funding their golden years appropriately. Individuals would benefit by adding an extra five years

to expected lifespan, while couples — who must consider that one partner will almost surely survive the other — should plan for an extra eight years.

Source: "The Madison Weekly Market Wrap", September 6, 2020, volume 7, issue 36.

This report provides general information only and is based upon current public information we consider reliable. Neither the information nor any opinion expressed constitutes an offer or an invitation to make an offer, to buy or sell any securities or other investment or any options, futures or derivatives related to such securities or investments. It is not intended to provide personal investment advice and it does not take into account the specific investment objectives, financial situation and the particular needs of any specific person who may receive this report. Investors should seek financial advice regarding the appropriateness of investing in any securities, other investment or investment strategies discussed or recommended in this report and should understand that statements regarding future prospects may not be realized. Investors should note that income from such securities or other investments, if any, may fluctuate and that price or value of such securities and investments may rise or fall. Accordingly, investors may receive back less than originally invested. Past performance is not necessarily a guide to future performance. Diversification does not guaranty against loss in declining markets.