Goldilocks Rally

Goldilocks Rally

On November 9th - all the major media outlets called the presidential election for former Vice President Joe Biden

by placing Pennsylvania’s 20 electoral votes into his column. President Trump has vowed to file legal challenges in a number of states and insists that he won the election.

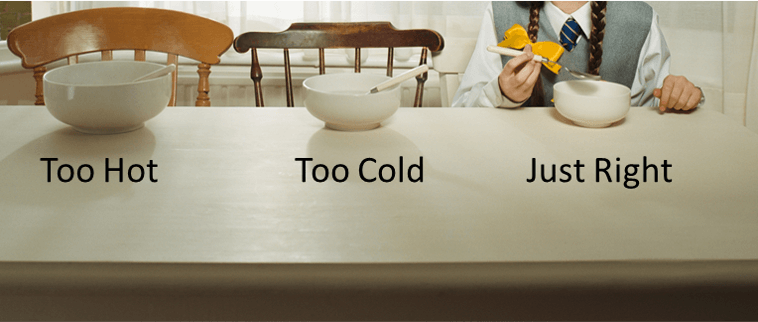

With Joe Biden having the clearest path to victory and Republicans seeming likely to retain control of the Senate, traders began to anticipate a Goldilocks scenario of additional fiscal stimulus but more limited tax increases

than under a “blue wave” Democratic sweep.

Domestic stocks posted their largest weekly rally since April. Bespoke reported; it was the best post-election rally since 1928, when Herbert Hoover was elected president.

The Nasdaq Composite and the small-cap Russell 2000 performed better than the S&P 500. Value stocks outperformed high-valuation growth companies early last week, but the momentum that has driven many growth stocks higher all year took control following Election Day.

The Federal Reserve held short-term borrowing rates near zero.

They met Wednesday and Thursday but announced no changes to monetary policy. The Fed’s post-meeting statement noted that the coronavirus pandemic continues to weigh on economic growth.

The U.S. economy added 638,000 jobs in October, the latest sign that the economic recovery has slowed. The unemployment rate fell to 6.9 from 7.9 percent, according to the Bureau of Labor Statistics.

COVID-19 has surged in many parts of the country, with more than 100,000 new daily cases reported nationwide and hospitalizations rising. This widely anticipated fall wave of the pandemic caused some states and municipalities to consider adding new restrictions on consumer businesses, threatening to slow the improvement

in the labor market.

Driven by election news. Indications that Republicans would retain control of the Senate led investors to revise down expectations for new stimulus spending in the new year, which could have weighed on Treasury prices.

Overseas Situation:

- European equities rallied, the pan-European STOXX Europe 600 ended the week 7.02 percent higher

- Germany’s DAX rallied 7.99 percent - France’s CAC 40 gained 7.98 percent - Italy’s FTSE MIB climbed 9.69 percent, and the UK’s FTSE 100 advanced 5.97 percent.

- Chinese stocks also advanced last week as the prospect of a Biden presidency raised the outlook for improved U.S.-China relations. The benchmark Shanghai Composite ended up 2.2 percent and the large-cap CSI 300 rose 3.4 percent.

- Japanese stocks finished sharply higher, the Nikkei 225 advanced 5.87 percent.

The pandemic is sinking one of the fast-food industry’s biggest bets: BREAKFAST.

Mornings are now the slowest time of day at fast-food restaurants

While the economy still isn’t close to a full recovery, it has rebounded impressively. The growing danger, however, is that the country is facing challenges that could set it back: COVID cases are rising, cold weather is on its way and, for many American households and small businesses, financial resources are running out.

Share

Tweet

Share

Mail

Contact Info

4710 W. Saginaw Hwy., Suite A

Lansing, MI 48917

517-323-2063

hmartin@wminstitute.com

Disclosures

Investing involves risk including the potential loss of principal. Consider your risks and objectives before investing. This is for informational purposes only and should not be construed as tax advice. Consult your tax advisor regarding your specific situation.

Securities and advisory services offered through Madison Avenue Securities, LLC, a Registered Investment Advisor, member FINRA and SIPC. Advisory services also offered through Wealth Management Institute, Inc., a Registered Investment Advisor. Wealth Management Institute and Madison Avenue Securities, LLC are not affiliated entities. Frank Cherniawski is securities registered in: AZ, CA, CT, FL, GA, IN, MI, MO, NC, OH, WA and Advisory Licensed in CA and MI with Madison Avenue Securities, LLC. Please inquire with the advisor about your state prior to further discussion or any decisions.

For Broker Check, click here

California Disclosures

Frank Cherniawski, Certified Financial Planner, is filed with the Commissioner and has not been disapproved. Personal state of domicile and principal place of business is Michigan. California Insurance License Number: 0B81627.

Privacy Policy

View Our Privacy Policy Here