Inflation Climbing Through February

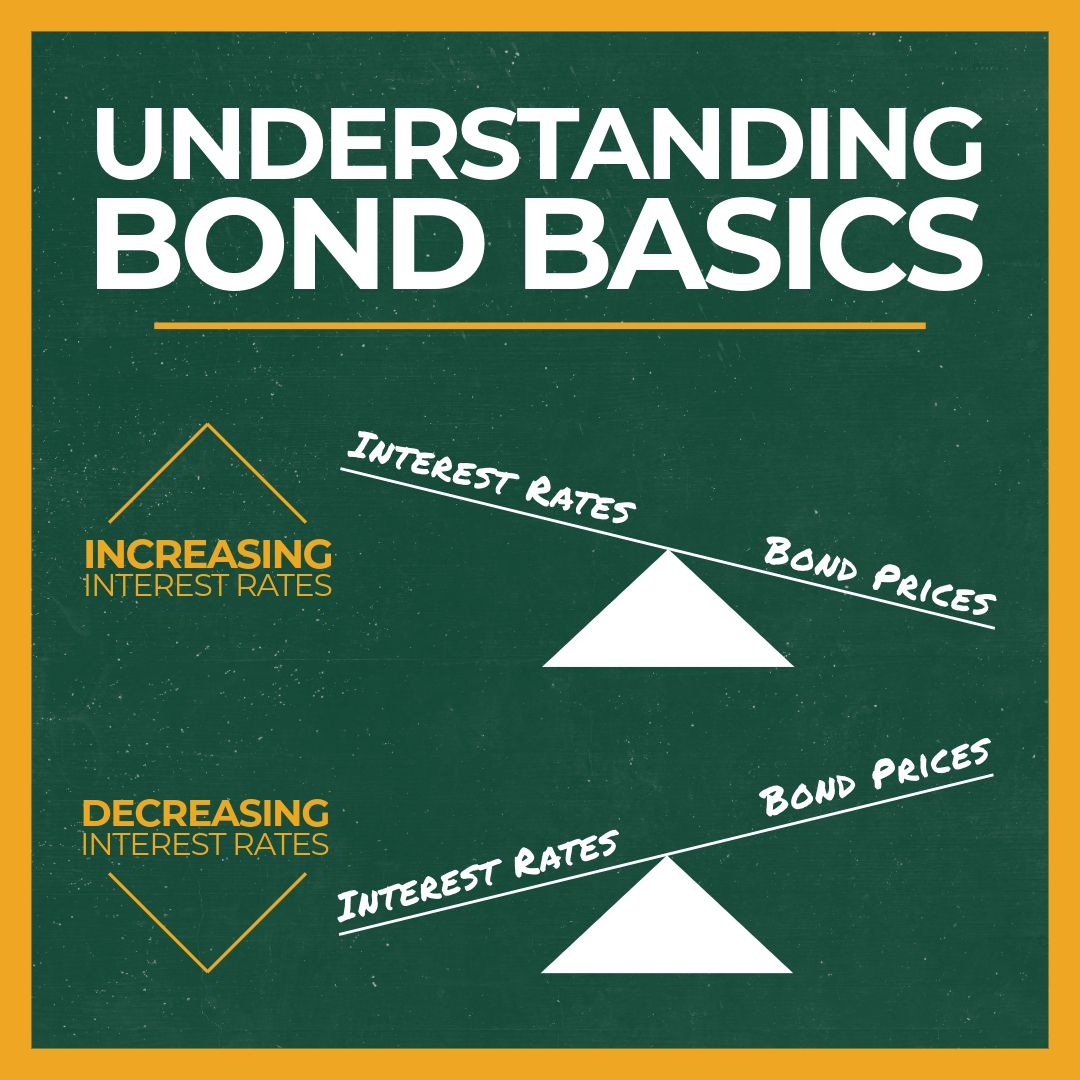

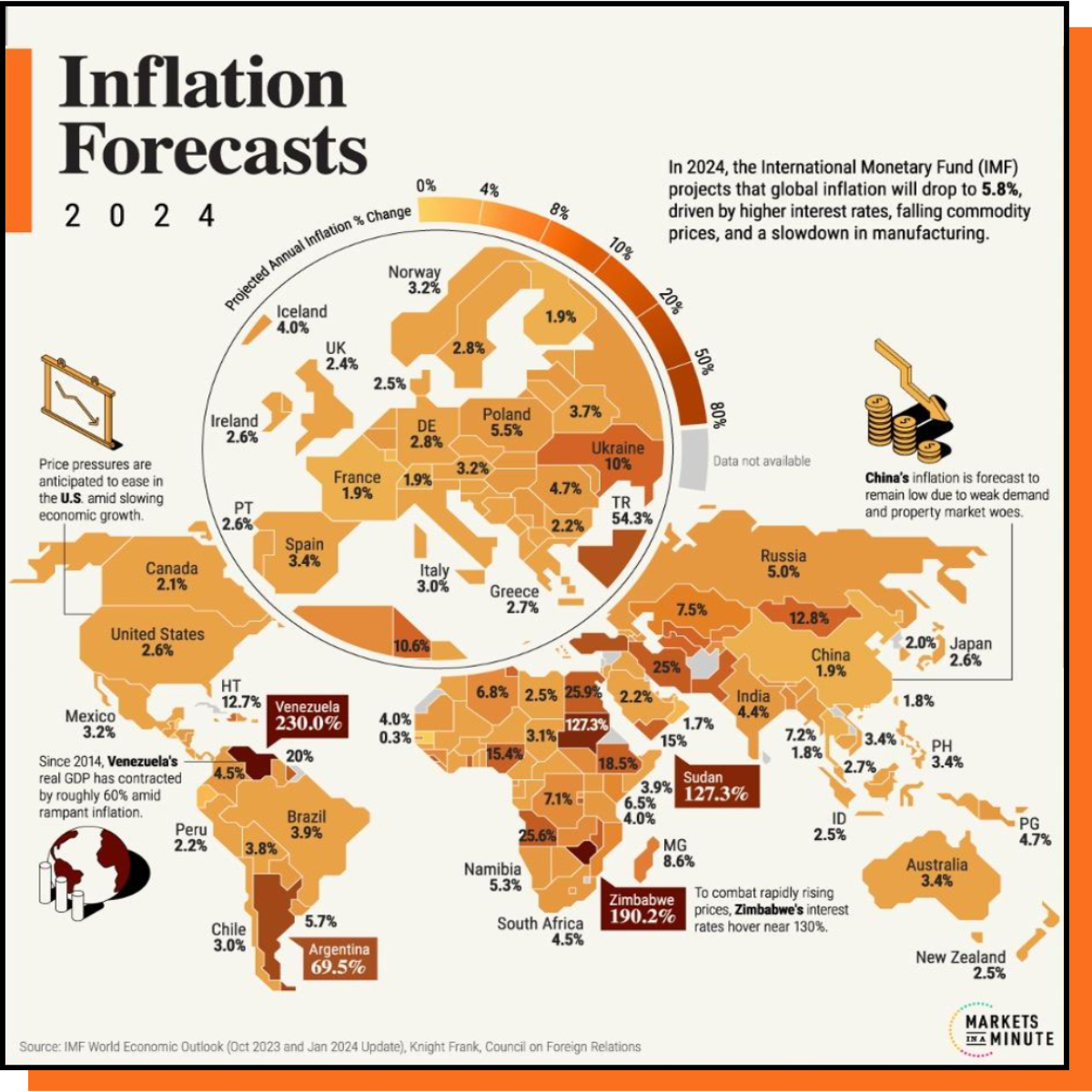

Inflation climbed 3.2% in the year through February, faster than expected, and a sign that inflation will likely prove difficult fully to eliminate. The fresh data underscore that returning inflation back to a consistently lower level is likely to be a bumpy process – and back up the Federal Reserve’s decision to proceed carefully as officials consider when and how much to lower interest rates.

The Bureau of Labor Statistics reported that the producer price index – a measure of what suppliers and wholesalers are charging customers – rose 0.6% month-over-month in February, double what economists expected.

U.S. consumers are proving a little less optimistic about the country’s economic outlook, despite a backdrop of easing inflation, energetic growth, and impending cuts to interest rates. The University of Michigan’s consumer-confidence survey slipped backward slightly to 76.5 in mid-March from 76.9 last month.

The Commerce Department reported that retail sales – spending on goods including food and fuel – increased by 0.6% month-over-month in February, slightly below expectations.

In the week ending March 9, the advance figure for seasonally adjusted initial jobless claims was 209,000, a decrease of 1,000 from the previous week’s revised level.

Last week, the S&P 500 notched its longest stretch since 2018 without a drop of at least 2%.

Inflation has taken a toll on consumers, who continue to experience sticker shock when buying daily essentials. For example, deodorant that costs twice as much as just a few years ago. Elsewhere, discount retailer Dollar Tree said it plans to close about 1,000 locations.

Investing involves risk including the potential loss of principal. Consider your risks and objectives before investing. This is for informational purposes only and should not be construed as tax advice. Consult your tax advisor regarding your specific situation.

Securities and advisory services offered through Madison Avenue Securities, LLC, a Registered Investment Advisor, member FINRA and SIPC. Advisory services also offered through Wealth Management Institute, Inc., a Registered Investment Advisor. Wealth Management Institute and Madison Avenue Securities, LLC are not affiliated entities. Frank Cherniawski is securities registered in: AZ, CA, CT, FL, GA, IN, MI, MO, NC, OH, WA and Advisory Licensed in CA and MI with Madison Avenue Securities, LLC. Please inquire with the advisor about your state prior to further discussion or any decisions.