The Great Retirement Boom Surges Again

Economists long expected the share of retirees in the population to soar as baby boomers aged. Covid-19 then caused the number to spike well beyond expectations, a surge dubbed the “Great Retirement Boom.” But just as they seemed to be coming back down, the numbers surged again in recent months, reaching a post-pandemic record in December. The U.S. now has around 2.7 million more retirees than expected.

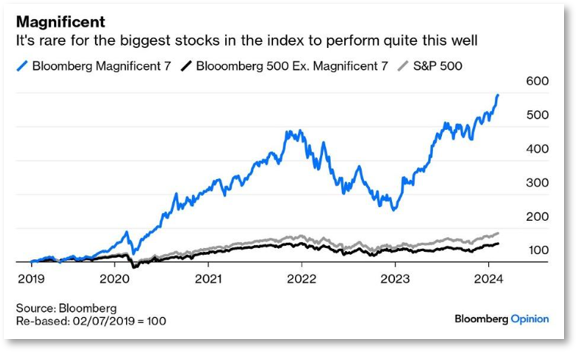

There’s a striking disconnect between the widely shared pessimism among Americans and measures that show the economy is robust. Consumers are spending briskly – behavior that suggests optimism, not retrenchment. Inflation has tempered. Unemployment has been below 4 percent for 24 straight months, the longest such stretch since the 1960s. The disconnect has puzzled economists, investors, and business owners. But press Americans harder, and the immediate economy emerges as only one factor in the gloomy outlook. Americans feel sour about the economy, many say, because their long-term financial security feels fragile and vulnerable to wide-ranging social and political threats.

The latest report on U.S. jobs showed a huge month for the economy, with the U.S. adding 353,000 jobs to start 2024. But there are some worrisome details.

Amid a confusion of artificial-intelligence narratives, “quant” analyses, and sustainable funds, the oldest and simplest stock-picking strategy – dividend investing – lies almost forgotten. There might be ways to dust it off.

Investing involves risk including the potential loss of principal. Consider your risks and objectives before investing. This is for informational purposes only and should not be construed as tax advice. Consult your tax advisor regarding your specific situation.

Securities and advisory services offered through Madison Avenue Securities, LLC, a Registered Investment Advisor, member FINRA and SIPC. Advisory services also offered through Wealth Management Institute, Inc., a Registered Investment Advisor. Wealth Management Institute and Madison Avenue Securities, LLC are not affiliated entities. Frank Cherniawski is securities registered in: AZ, CA, CT, FL, GA, IN, MI, MO, NC, OH, WA and Advisory Licensed in CA and MI with Madison Avenue Securities, LLC. Please inquire with the advisor about your state prior to further discussion or any decisions.