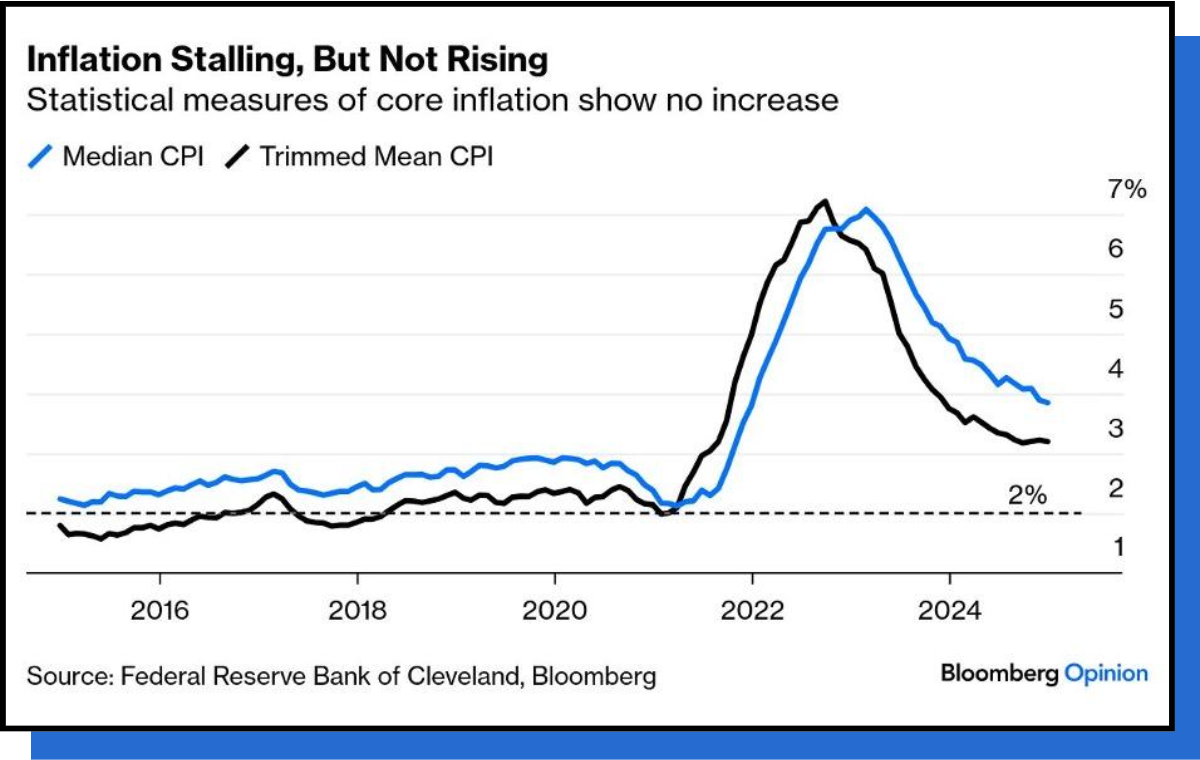

Inflation Stalling, But Not Rising

Statistical measures of core inflation show no increase. The Consumer Price Index rose 0.4% month-over-month and 2.9% annually in December. While the leading numbers did indeed show inflation coming under control a slightly greater deal than had been expected, they left no clarity about the way ahead.

Writing for Works in Progress, economics professor Carola Conces Binder unpacked the history of the tool we use to measure inflation, the consumer price index. “The CPI and related measures affect monetary and fiscal policymaking and are often used to adjust Social Security payments, income tax brackets, and wages for millions of workers,” she wrote. “Because of these far-reaching impacts, even relatively small changes in the measurement of the CPI can have major implications for households, firms, and the government’s budget. Thus, the technocratic task of measuring the price level is often at the center of political controversies. The evolution of inflation measurement in the United States has reflected both technical progress and these political forces.”

Investing involves risk including the potential loss of principal. Consider your risks and objectives before investing. This is for informational purposes only and should not be construed as tax advice. Consult your tax advisor regarding your specific situation.

Securities and advisory services offered through Madison Avenue Securities, LLC, a Registered Investment Advisor, member FINRA and SIPC. Advisory services also offered through Wealth Management Institute, Inc., a Registered Investment Advisor. Wealth Management Institute and Madison Avenue Securities, LLC are not affiliated entities. Frank Cherniawski is securities registered in: AZ, CA, CT, FL, GA, IN, MI, MO, NC, OH, WA and Advisory Licensed in CA and MI with Madison Avenue Securities, LLC. Please inquire with the advisor about your state prior to further discussion or any decisions.