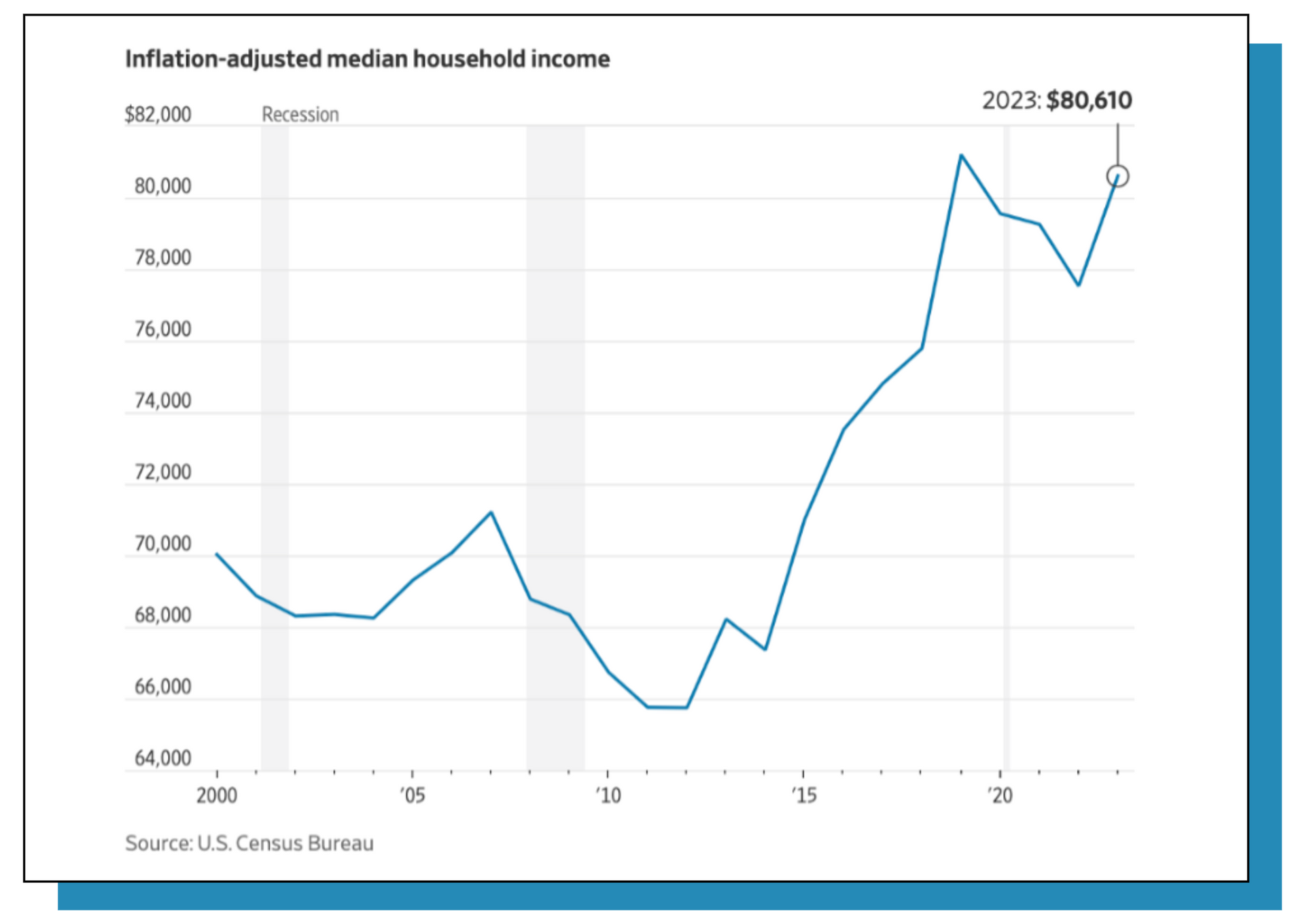

Household Incomes Rose Last Year for the First Time Since the Covid-19 Pandemic

Household incomes rose last year for the first time since the Covid-19 pandemic began, reflecting the effects of easing inflation and a strong job market. The new data from the U.S. Census Bureau on Tuesday signaled an

improvement in 2023 after inflation that spiked to a 40-year-high the prior year swallowed up household income gains.

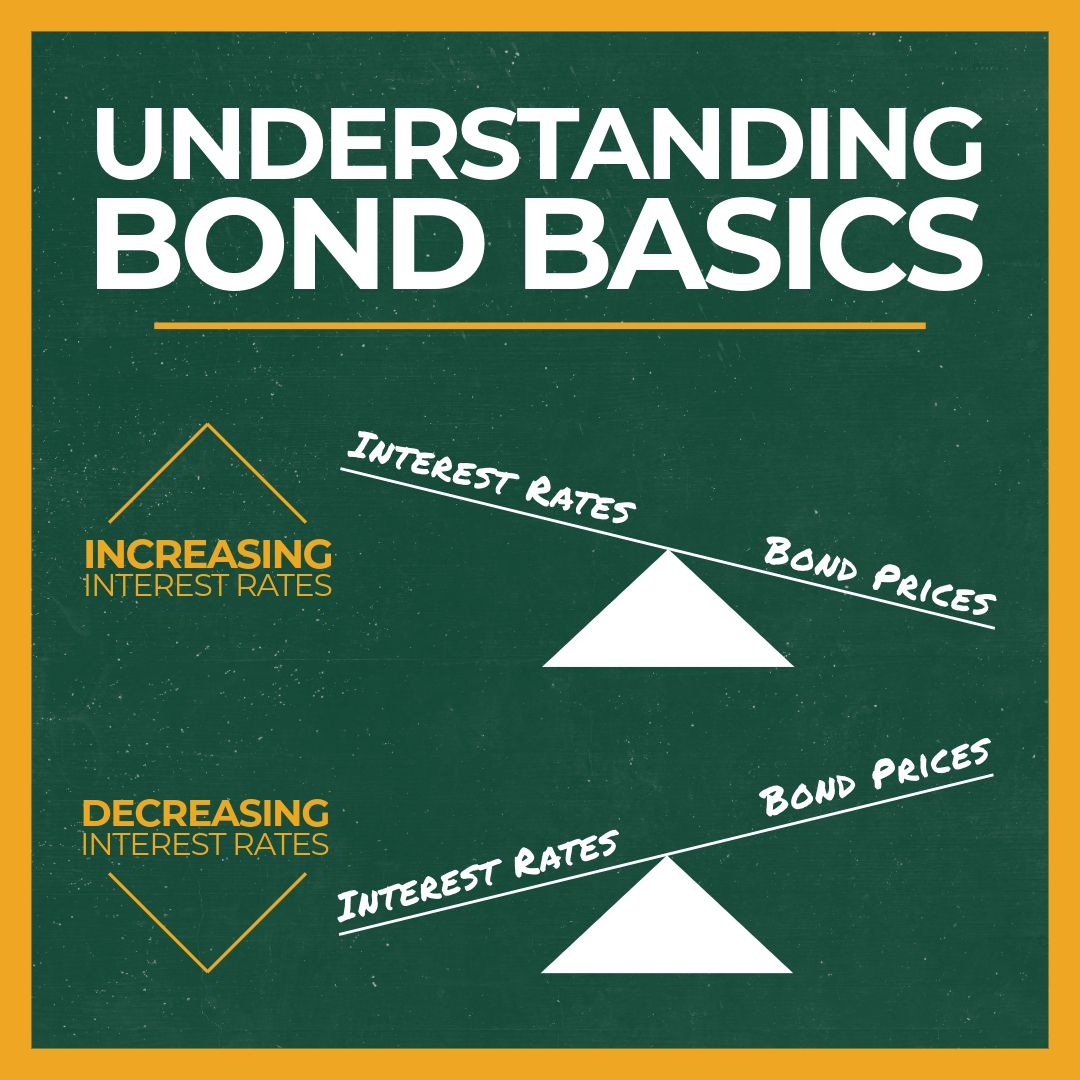

Federal Reserve Chair Jerome Powell faces a difficult decision as the central bank prepares to cut interest rates next week: Start small or begin big?

The Consumer Price Index (CPI), a measure of inflation, rose 0.2% month-over-month and 2.5% annually in August, the Bureau of Labor Statistics reported on Wednesday, marking the lowest point of annual inflation since February 2021. The figures likely cemented Federal Reserve officials’ decision to cut interest rates by a quarter of a percentage point next week.

Producer inflation was relatively tame in August, keeping alive expectations that the Federal Reserve will cut interest rates very soon. Wholesale prices have been more volatile than consumer prices in 2024 but remain on track for the Fed’s goals.

Investing involves risk including the potential loss of principal. Consider your risks and objectives before investing. This is for informational purposes only and should not be construed as tax advice. Consult your tax advisor regarding your specific situation.

Securities and advisory services offered through Madison Avenue Securities, LLC, a Registered Investment Advisor, member FINRA and SIPC. Advisory services also offered through Wealth Management Institute, Inc., a Registered Investment Advisor. Wealth Management Institute and Madison Avenue Securities, LLC are not affiliated entities. Frank Cherniawski is securities registered in: AZ, CA, CT, FL, GA, IN, MI, MO, NC, OH, WA and Advisory Licensed in CA and MI with Madison Avenue Securities, LLC. Please inquire with the advisor about your state prior to further discussion or any decisions.