Understanding Bond Basics

Bonds can help you add diversification and stability to your overall retirement strategy and are commonly considered less volatile than stocks. In fact, as interest rates have generally declined since the early 1980s, many bonds have provided solid long-term returns.

However, while bonds can be an attractive addition to an overall retirement income strategy, they are not without risk. In fact, if you’re counting on bonds to help you save for retirement or to generate retirement income, you could find that their value has decreased when it’s time for you to cash in or reinvest in another bond.

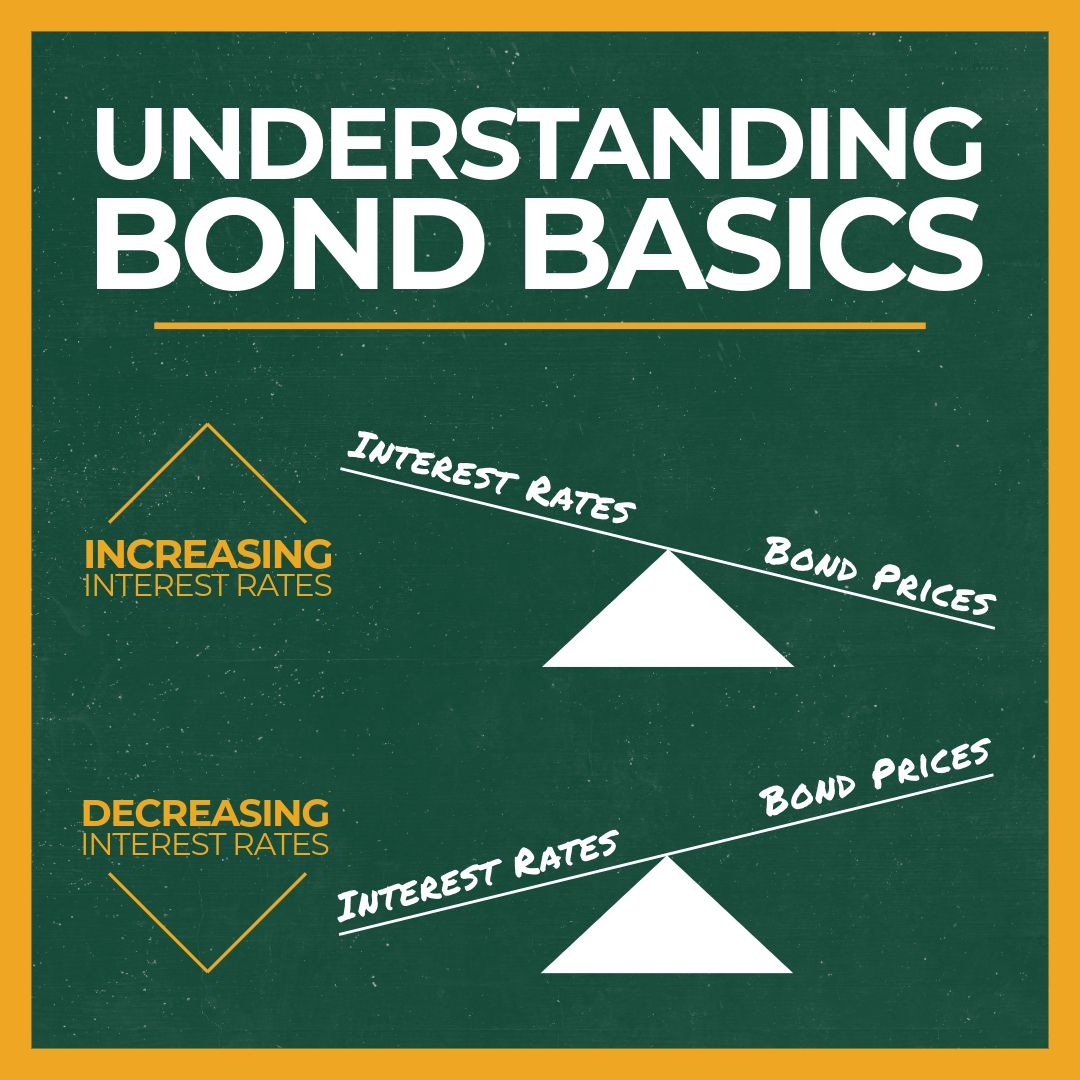

Bonds fluctuate in value in inverse correlation to changes in interest rates. When interest rates go up, a bond’s value goes down, and vice versa. Contact Wealth Management Institute so we can help you plan your financial future!

Investing involves risk including the potential loss of principal. Consider your risks and objectives before investing. This is for informational purposes only and should not be construed as tax advice. Consult your tax advisor regarding your specific situation.

Securities and advisory services offered through Madison Avenue Securities, LLC, a Registered Investment Advisor, member FINRA and SIPC. Advisory services also offered through Wealth Management Institute, Inc., a Registered Investment Advisor. Wealth Management Institute and Madison Avenue Securities, LLC are not affiliated entities. Frank Cherniawski is securities registered in: AZ, CA, CT, FL, GA, IN, MI, MO, NC, OH, WA and Advisory Licensed in CA and MI with Madison Avenue Securities, LLC. Please inquire with the advisor about your state prior to further discussion or any decisions.