More Solid Gains

More Solid Gains

Stocks recorded solid gains last week, pushing the tech-heavy Nasdaq Composite to new highs and lifting the S&P 500 to within roughly 1.2 percent of its February record peak. The small-cap Russell 2000 outperformed by a wide margin, helping it recover some of its lost ground for the year-to-date. Industrials benefited from hopes for new aid to airlines, while health care stocks lagged. It was the last major week of the earnings season, with 132 S&P 500 companies reporting second-quarter results.

Stocks drifted higher through much of the week. Manufacturing signals remained encouraging, with July factory orders rising more than expected and the Institute for Supply Management’s gauge of factory activity surprising on the upside to reach its highest level since early 2019. The Institute’s services sector gauge also came in better than expected.

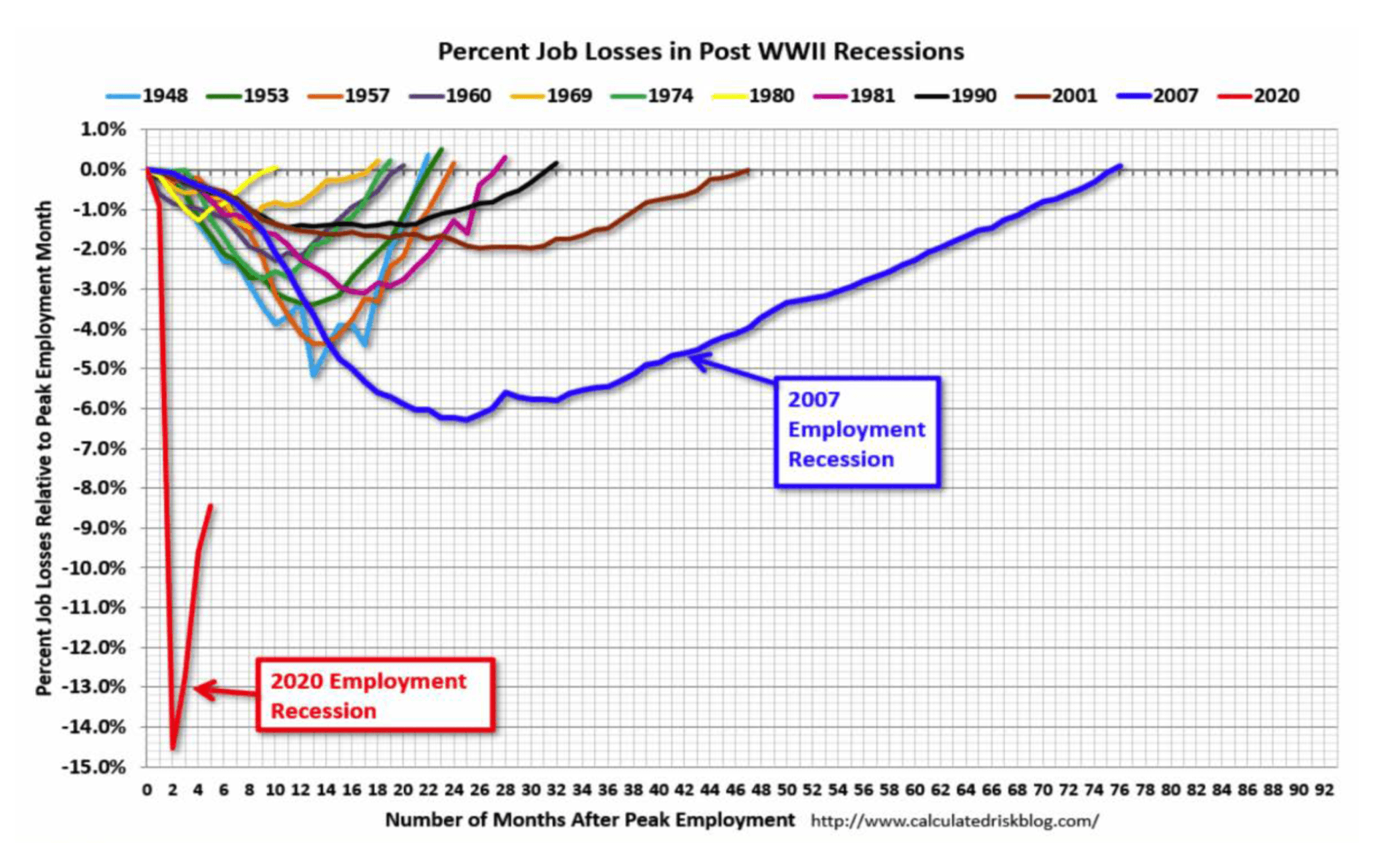

Labor market data was also encouraging. A daunting 1.2 million Americans filed weekly jobless claims, but it broke a string of two weekly increases and marked the lowest level since the onslaught of the pandemic and business closings in early March. On Wednesday, ADP announced a much smaller-than-expected rise in its tally of July private payrolls, but the Labor Department’s official July count surprised on the upside when it was released Friday — employers added 1.76 million jobs in the month, fostering a further decline in the unemployment rate, from 11.1 to 10.2 percent. The underlying data were perhaps less encouraging, with much of the payroll increase due to the timing of a seasonal adjustment to educational hiring. The labor force participation rate also dropped slightly.

The yield on the benchmark 10-year U.S. Treasury note touched a new five-month low on Thursday before increasing on Friday following the jobs report, leaving it modestly higher for the week.

European stocks rose last week on signs that an economic recovery may be gaining traction there and on hopes for more U.S. stimulus. However, escalating tensions between the U.S. and China and fears that Europe could suffer a resurgence of coronavirus cases curbed equity market gains. In local currency terms, the pan-European STOXX Europe 600 ended the week 2.03 percent higher, Germany’s Xetra DAX rose 2.94 percent, France’s CAC 40 gained 2.21 percent, Italy’s FTSE MIB climbed 2.22 percent, and the UK’s FTSE 100 advanced 2.28 percent.

Mainland Chinese markets rallied last week after data lifted confidence in the economic recovery. The large-cap CSI 300 and benchmark Shanghai Composite each posted solid gains, even after declining on Friday on news that President Trump tightened restrictions on Chinese social media networks TikTok and WeChat in the U.S. In another sign of the growing tech rift between the U.S. and China, San Jose-based video conferencing company Zoom, which gained popularity during the pandemic, said that it would halt direct sales to China and only provide video conferencing services through third-party partners. Elsewhere in Asia, following a steep decline at the end of July, Japanese stocks rallied in the first week of August. The Nikkei 225 advanced nearly 3 percent last week.

Source: "The Madison Weekly Market Wrap", August 30, 2020, Volume 7, Issue 35.

This report provides general information only and is based upon current public information we consider reliable. Neither the information nor any opinion expressed constitutes an offer or an invitation to make an offer, to buy or sell any securities or other investment or any options, futures or derivatives related to such securities or investments. It is not intended to provide personal investment advice and it does not take into account the specific investment objectives, financial situation and the particular needs of any specific person who may receive this report. Investors should seek financial advice regarding the appropriateness of investing in any securities, other investment or investment strategies discussed or recommended in this report and should understand that statements regarding future prospects may not be realized. Investors should note that income from such securities or other investments, if any, may fluctuate and that price or value of such securities and investments may rise or fall. Accordingly, investors may receive back less than originally invested. Past performance is not necessarily a guide to future performance. Diversification does not guaranty against loss in declining markets.

Share

Tweet

Share

Mail

Contact Info

4710 W. Saginaw Hwy., Suite A

Lansing, MI 48917

517-323-2063

hmartin@wminstitute.com

Disclosures

Investing involves risk including the potential loss of principal. Consider your risks and objectives before investing. This is for informational purposes only and should not be construed as tax advice. Consult your tax advisor regarding your specific situation.

Securities and advisory services offered through Madison Avenue Securities, LLC, a Registered Investment Advisor, member FINRA and SIPC. Advisory services also offered through Wealth Management Institute, Inc., a Registered Investment Advisor. Wealth Management Institute and Madison Avenue Securities, LLC are not affiliated entities. Frank Cherniawski is securities registered in: AZ, CA, CT, FL, GA, IN, MI, MO, NC, OH, WA and Advisory Licensed in CA and MI with Madison Avenue Securities, LLC. Please inquire with the advisor about your state prior to further discussion or any decisions.

For Broker Check, click here

California Disclosures

Frank Cherniawski, Certified Financial Planner, is filed with the Commissioner and has not been disapproved. Personal state of domicile and principal place of business is Michigan. California Insurance License Number: 0B81627.

Privacy Policy

View Our Privacy Policy Here