Supply Chain Woe's Continue

Nothing embodied the promise of globalization more than the humble supply chain. Thanks to the integration of production across and within borders, consumers have come to expect infinite variety, instantly availabilitye. That is now under siege.

The world’s biggest companies are using their deep pockets, global operations and market share to insulate themselves from the supply-chain meltdown.

The S&P 500, the Dow Jones Industrial Average, and the S&P MidCap 400 hit record highs mid October, aided by a series of positive earnings surprises. Real estate and utilities stocks and health care shares led the S&P gainers, boosted by insurance providers.

Social media stocks dropped sharply following downward guidance from Snapchat parent Snap, blaming new privacy settings on Apple’s iPhones. Energy shares also underperformed after strong recent gains.

Stocks mostly moved higher. Traders appeared to be paying close attention to how higher energy and raw materials prices were affecting both third-quarter profits and future guidance.

The percentage of companies beating revenue estimates was also near record levels.

Hopes for additional fiscal stimulus also appeared to bolster sentiment.

At a CNN town hall event, President Biden said that his party was close to striking a deal and that increased corporate taxes were unlikely to be included in the legislation.

Economic data was mixed. This was especially true in the housing sector, where both housing starts and building permits came in well below expectations, while existing home sales jumped unexpectedly to their highest level since January.

Industrial production fell 1.3% in September, explained by disruptions from Hurricane Ida and ongoing supply chain issues in the auto industry.

Jobless claims fell more than consensus expectations and reached new pandemic-era lows.

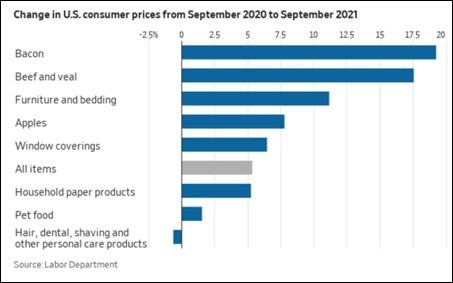

Uncomfortably high inflation will grip the U.S. economy well into 2022, as constrained supply chains keep upward pressure on prices and curb output, according to economists surveyed this month by The Wall Street Journal.

The economists’ inflation projections are up dramatically from July, while short-term growth outlooks are lower.

As of August 2021, there were slightly over 3 million excess retirements due to Covid-19, more than half of the 5.25 million people leaving the labor force from the beginning of the pandemic to the second quarter of 2021.

Reasons:

- Early retirement,

- Sharp downturn in economic activity

- Rising asset values, such as housing and stocks.

Source: “The Madison Weekly Market Wrap”, October 24, 2021.

Investing involves risk including the potential loss of principal. Consider your risks and objectives before investing. This is for informational purposes only and should not be construed as tax advice. Consult your tax advisor regarding your specific situation.

Securities and advisory services offered through Madison Avenue Securities, LLC, a Registered Investment Advisor, member FINRA and SIPC. Advisory services also offered through Wealth Management Institute, Inc., a Registered Investment Advisor. Wealth Management Institute and Madison Avenue Securities, LLC are not affiliated entities. Frank Cherniawski is securities registered in: AZ, CA, CT, FL, GA, IN, MI, MO, NC, OH, WA and Advisory Licensed in CA and MI with Madison Avenue Securities, LLC. Please inquire with the advisor about your state prior to further discussion or any decisions.