The Santa Claus Rally

“Santa Claus rally” lifted the S&P 500 to record highs as most of the major domestic indexes recorded gains in the last week of 2021.

The technology-heavy Nasdaq Composite lagged and finished flat.

The real estate, utilities, and materials sectors outperformed within the S&P 500, while the larger communication services and information technology sectors—which together account for over one-third of the index—lagged.

Despite daily coronavirus cases rising to record highs, waning fears over the omicron variant appeared

to deserve much of the credit for the gains.

- Hospitalization rates remained contained

- The CDC reduced the recommended quarantine period for asymptomatic people who have tested positive from 10 days to five.

- Crew shortages caused by the virus led to flight cancellations and declines in airline stocks.

Evidence the latest wave of the virus was also having a milder effect on economic activity. Weekly jobless claims fell back to near five-decade lows, and continuing claims fell much more than expected and hit their lowest level since the onset of the pandemic.

An index of manufacturing activity in the Mid-Atlantic region also showed accelerating growth. Pending home sales were an outlier, surprising on the downside, as high prices and limited inventory seemed to be dissuading buyers.

Americans seemed ready to spend on goods - according to data compiled by MasterCard, holiday sales rose 8.5 percent in December versus a year earlier, the biggest gain in 17 years. Sales were also 10.7 percent higher than pre-pandemic levels in 2019. The data suggested that supply and labor challenges might be easing for retailers while also allowing them to pass on higher costs to customers.

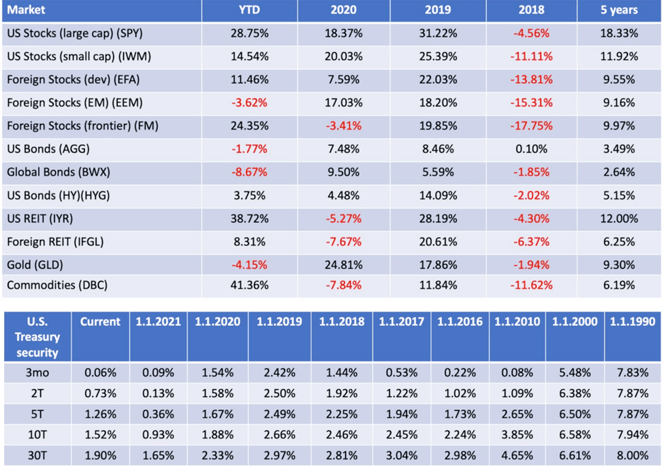

Year to Date for 2021 Stocks and Bond Market

Retail stocks generally fared well on the news but declines in Amazon and casino and cruise ship operators weighed on the consumer discretionary sector as a whole. On Thursday, the CDC recommended against cruise ship travel, even for those who are fully vaccinated.

European stocks rose, due to easing omicron fears and optimism about the economic recovery. The pan-European STOXX Europe 600 ended last week 1.09 percent higher, rebounding more than 22% during 2021.

Japan’s stock market activity was muted, with the Nikkei 225 up 0.03% and the broader TOPIX gaining 0.28%. Sentiment was dampened by the spread of the omicron variant through community transmission in the country.

Chinese markets ended a tumultuous year with modest losses last week. The large-cap CSI 300 declined 0.2% and the Shanghai Composite shed 0.1%.

Quote for the Month: “The value of stocks, bonds, real estate, art, and cash rises and falls, but Time only becomes more valuable as we spend more of it.” ~ Barry Ritholtz

Source: “The Madison Weekly Market Wrap”, December January 2, 2022.

Investing involves risk including the potential loss of principal. Consider your risks and objectives before investing. This is for informational purposes only and should not be construed as tax advice. Consult your tax advisor regarding your specific situation.

Securities and advisory services offered through Madison Avenue Securities, LLC, a Registered Investment Advisor, member FINRA and SIPC. Advisory services also offered through Wealth Management Institute, Inc., a Registered Investment Advisor. Wealth Management Institute and Madison Avenue Securities, LLC are not affiliated entities. Frank Cherniawski is securities registered in: AZ, CA, CT, FL, GA, IN, MI, MO, NC, OH, WA and Advisory Licensed in CA and MI with Madison Avenue Securities, LLC. Please inquire with the advisor about your state prior to further discussion or any decisions.