Sentiment Wanes on Worries of Ukraine & Inflation

The domestic large-cap indexes suffered their second consecutive week of declines as worries over a Russian invasion of Ukraine and high inflation weighed on sentiment.

A steep decline in Meta Platforms (Facebook) hurt the communication services sector.

Conflicting signals on whether Russian troops were preparing to cross the border with Ukraine appeared to whipsaw markets throughout last week. Stocks fell on Monday afternoon following a CNN report that the president of Ukraine, Volodymyr Zelensky, said the government had been informed that the coming Wednesday would “be the day of attack.” The indexes then rallied on Tuesday, after Russian President Vladimir Putin said he hoped for a diplomatic solution to tensions with the U.S. and its allies and announced a partial pullback of troops near the Ukrainian border. Stocks then reversed course and headed lower again on Thursday, after U.S. officials stated that there was no evidence of a pullback and that an invasion was “imminent.”

Contradictory signs from the Federal Reserve fostered volatility. St. Louis Fed President James Bullard told a CNBC interviewer that policymakers “surprised to the upside on inflation” and that the Fed’s “credibility was on the line.” On Thursday, Bullard said in another interview that he expected a full percentage point of federal funds rate increases by July.

The Federal Reserve is all but assured to begin hiking interest rates next month to try to rein in runaway inflation, and, although most economists would argue the move is necessary, it doesn’t come without risks.

Weekly jobless claims rose for the first time in a month, and two regional manufacturing indexes surprised on the downside.

Retail sales rebounded by 3.8% in January, more than expected and the most since last spring.

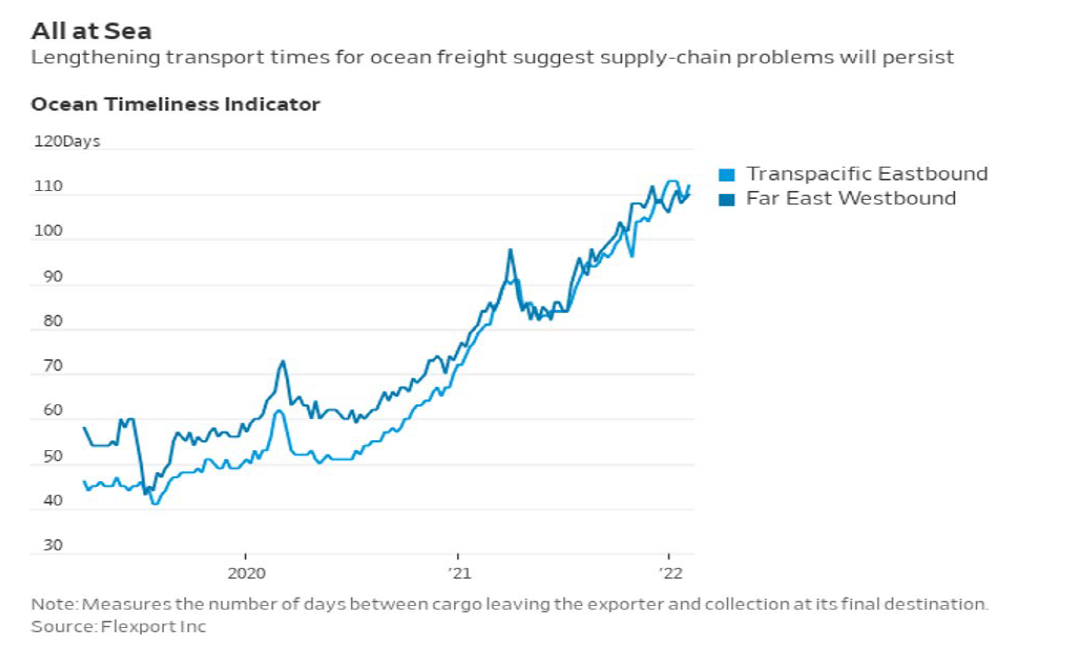

Delays and rising costs to move shipping containers are sinking hopes that the world’s supply-chain problems will ease anytime soon.

Shares in Europe fell amid continuing geopolitical tensions over Ukraine and uncertainty about monetary policy.

Germany’s DAX tumbled 2.48%, Italy’s FTSE MIB down 1.7%, France’s CAC 40 slipped 1.17%, and the UK’s FTSE 100 pulled back 1.92%.

Japan’s stock markets generated a negative return last week, weighed down by geopolitical tensions in Ukraine

Chinese markets rose modestly as supportive comments from government officials and lower-than-expected inflation data.

U.S. home sales unexpectedly increased in January, but investors paying in cash are squeezing out first-time buyers from the housing market amid record low inventory and higher prices. U.S. suppliers sharply boosted prices last month, in a sign upward pressure on already high consumer inflation continued to build at the start of the year.

Inflation is seeping through American business, hitting companies in unexpected ways beyond higher prices for materials, shipping or wages.

Investing involves risk including the potential loss of principal. Consider your risks and objectives before investing. This is for informational purposes only and should not be construed as tax advice. Consult your tax advisor regarding your specific situation.

Securities and advisory services offered through Madison Avenue Securities, LLC, a Registered Investment Advisor, member FINRA and SIPC. Advisory services also offered through Wealth Management Institute, Inc., a Registered Investment Advisor. Wealth Management Institute and Madison Avenue Securities, LLC are not affiliated entities. Frank Cherniawski is securities registered in: AZ, CA, CT, FL, GA, IN, MI, MO, NC, OH, WA and Advisory Licensed in CA and MI with Madison Avenue Securities, LLC. Please inquire with the advisor about your state prior to further discussion or any decisions.