Stocks Up - Sentiment Down - Stocks Hold

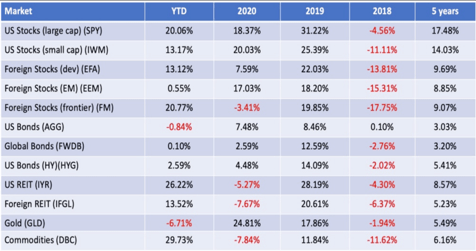

Stocks:

- Within the S&P 500, value stocks outperformed their growth counterparts.

- Energy stocks slipped Information technology stocks also lagged, driven by the pullback in the semiconductors

- U.S. Treasury yields climbed, led by increases in long-maturity.

- European stocks also advanced – consistent with U.S. activity.

- Japan’s stock market registered modest gains

- Chinese stocks also recorded modest gains.

Senate passed a roughly $1 trillion bipartisan infrastructure package, including $550 billion in new spending, aimed to rebuild transportation infrastructure, improve access to internet in rural areas, and upgrade the electric grid and water.

Senate Democrats also approved a $3.5 trillion budget resolution, to address administration priorities such as improving access to education and increasing support for families with children.

Vaccination is increasingly a requirement to be hired, as employers are asking applicants to be inoculated against Covid-19.

U.S. producer prices jumped in July, suggesting strong demand and supply chain bottlenecks are pushing costs higher.

New applications for jobless benefits declined for the third straight week, showing the labor market continues to heal despite worries about the Delta variant.

Available jobs in the U.S. rose to another record high at the end of June, pushing openings above the number of unemployed Americans seeking work.

Investing involves risk including the potential loss of principal. Consider your risks and objectives before investing. This is for informational purposes only and should not be construed as tax advice. Consult your tax advisor regarding your specific situation.

Securities and advisory services offered through Madison Avenue Securities, LLC, a Registered Investment Advisor, member FINRA and SIPC. Advisory services also offered through Wealth Management Institute, Inc., a Registered Investment Advisor. Wealth Management Institute and Madison Avenue Securities, LLC are not affiliated entities. Frank Cherniawski is securities registered in: AZ, CA, CT, FL, GA, IN, MI, MO, NC, OH, WA and Advisory Licensed in CA and MI with Madison Avenue Securities, LLC. Please inquire with the advisor about your state prior to further discussion or any decisions.

Source: “The Madison Weekly Market Wrap”, August 22, 2021.