Feds Most Aggressive Rate Hike Since 1994

The Federal Reserve’s most aggressive rate hike since 1994 raised recession fears and sent stocks sharply lower for a second consecutive week. The S&P 500 recorded its worst weekly decline since March 2020 and entered a bear market, ending the mid June nearly 24% below its January peak.

On June 13th, every member of the S&P 500 was in negative territory at one point, something that hasn’t happened since at least 1996.

The Fed’s policy committee announced on June 15th that it was raising the federal funds rate by 75bps to a target range of 1.5% to 1.75%, its highest level since early 2020.

US mortgage rates hit their highest level in more than 13 years, the latest sign of market repercussions from the Fed’s efforts to bring inflation under control through higher borrowing costs.

The mood on Wall Street seemed to sour, perhaps due to worrisome signs that the economy might be more vulnerable to a slowdown than Powell envisioned. Several reports indicated that the housing sector was already feeling the impact of Fed tightening and the surge in mortgage rates:

• Building permits fell 7% in May to their lowest level since last September

• Housing starts sank 14.4%, the biggest drop since the onset of the pandemic.

Weekly jobless claims also came in higher than expected (229,000 versus roughly 210,000).

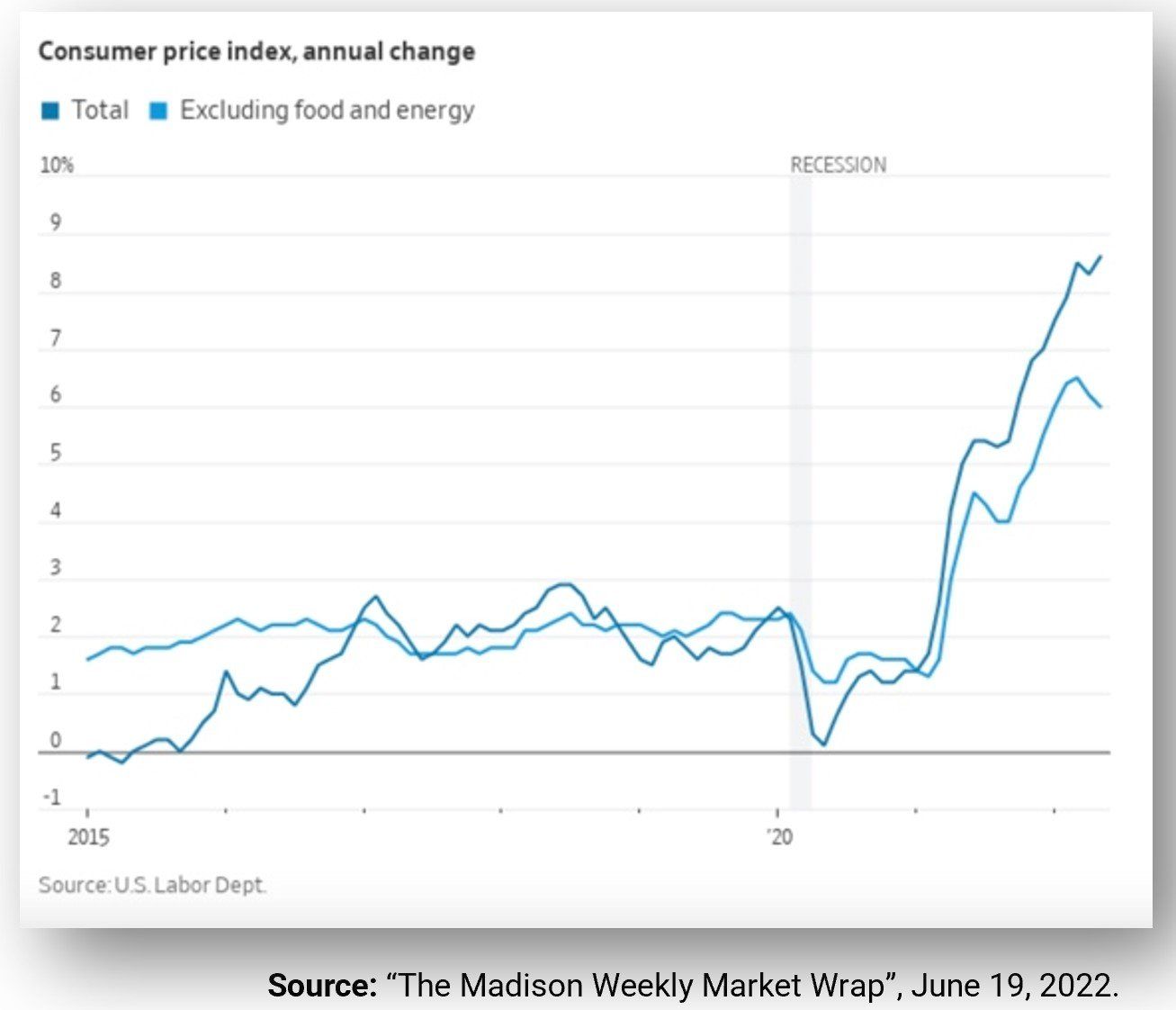

Retail sales data further stoked recession fears. Overall sales fell 0.3% in May, dragged lower by a sharp decline in auto purchases. The data confirmed consumers were buying less in real terms given the higher year-over-year increase in consumer inflation of 8.6%.

Shares in Europe fell sharply on concerns that economic growth may stall after several central banks announced rate increases. The pan-European STOXX Europe 600 ended 4.6%.

Major country indexes also recorded material declines

• Germany’s DAX dropped 4.62% France’s CAC 40 declined 4.92%, Italy’s FTSE MIB lost 3.36%, and the UK’s FTSE 100 pulled back 4.12%

• In Asia, Japan’s stock markets registered sharp losses for mid June, with the Nikkei 225 down 6.69%

• Alone among the major country indexes, Chinese stock markets advanced as the Shanghai Composite added 1% and the blue-chip CSI rose 1.4%, its highest level in three months.

Investing involves risk including the potential loss of principal. Consider your risks and objectives before investing. This is for informational purposes only and should not be construed as tax advice. Consult your tax advisor regarding your specific situation.

Securities and advisory services offered through Madison Avenue Securities, LLC, a Registered Investment Advisor, member FINRA and SIPC. Advisory services also offered through Wealth Management Institute, Inc., a Registered Investment Advisor. Wealth Management Institute and Madison Avenue Securities, LLC are not affiliated entities. Frank Cherniawski is securities registered in: AZ, CA, CT, FL, GA, IN, MI, MO, NC, OH, WA and Advisory Licensed in CA and MI with Madison Avenue Securities, LLC. Please inquire with the advisor about your state prior to further discussion or any decisions.