Americans Stressed About Money

Americans are more stressed about money than they’ve ever been, according to the American Psychological Association’s latest Stress In America Survey. “87% of Americans said that inflation and the rising costs of everyday goods is what’s driving their stress,” More than 40% of U.S. adults say money is negatively impacting their mental health, according to Bankrate’s April 2022 Money and Mental Health report.

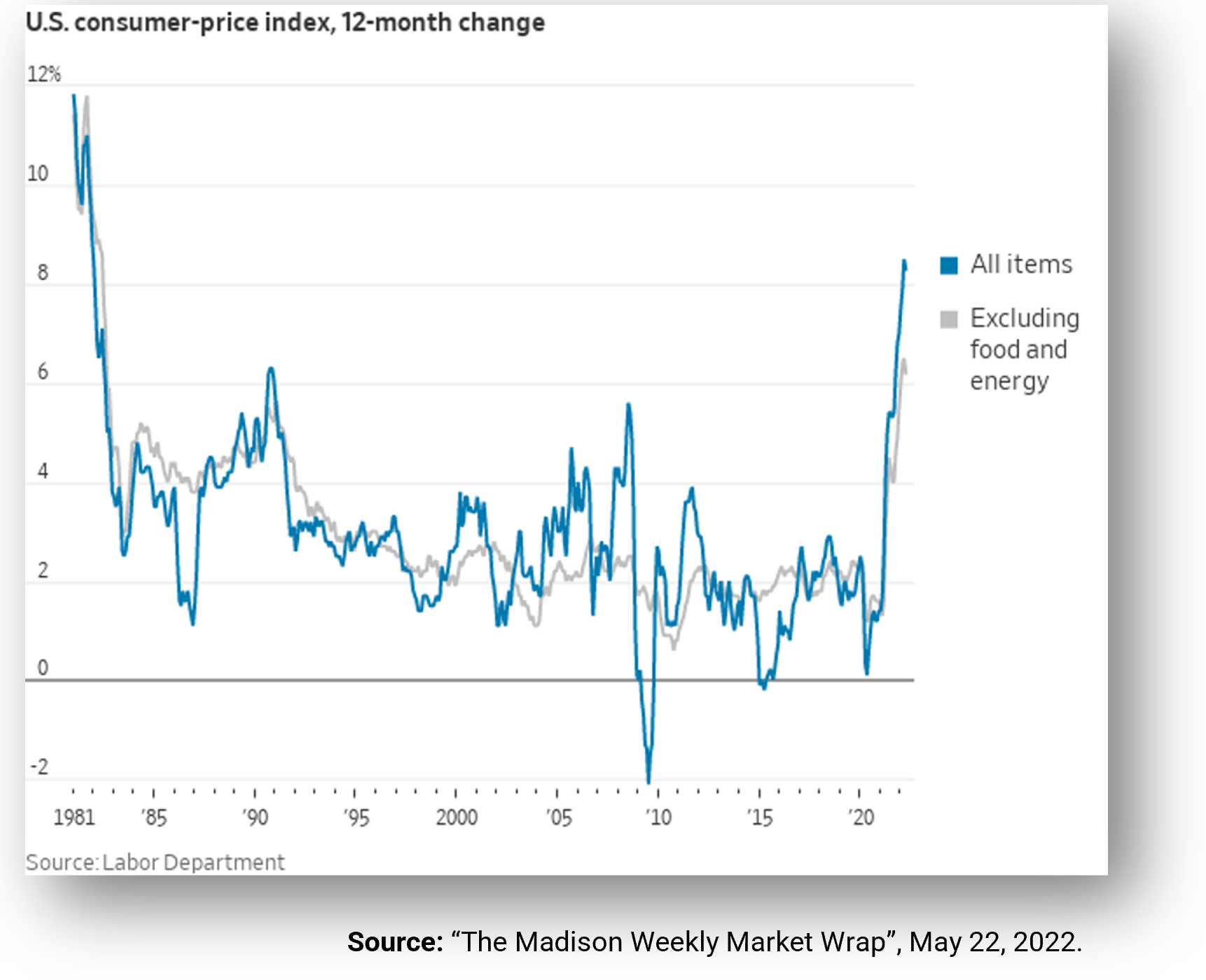

Wall Street continued its weekly losing streak as fears grew that inflation was causing consumers to pull back on discretionary spending, setting the stage for a coming recession. At its low point in late May, the S&P 500 was down roughly 20.9% from its January intraday high.

Disappointing earnings and revenue results from several of the nation’s major retailers

appeared to spill over into negative broader sentiment target fell roughly 25% after earnings fell short of estimates by nearly a third, which the company attributed to a combination of reduced sales of discretionary items, such as televisions, and higher costs. Results from Walmart, Lowe’s, and Home Depot also fell short of expectations, while Costco shares may have tumbled in part on (apparently false) rumors that it was raising the price of its popular food court hot dog.

A gauge of manufacturing activity in the Mid-Atlantic region fell short of expectations by a wide margin and weekly jobless claims rose more than expected. Housing starts and existing home sales also came in lower than expected, reflecting the pressure from higher mortgage rates.

The hard evidence continues to show that the U.S. economy is booming. Retail sales grew 0.9% to a record $677.7 billion in April from March, according to a Census Bureau report released Tuesday. Restaurants and bars, department stores, electronics and appliance stores, and clothing stores led growth.

Consumers continue to be in good shape financially. They’re sitting on more than $2 trillion worth of excess savings, which continues to represent a massive tailwind for the economy. The U.S. labor market has also added a whopping 2.1 million jobs this year.

The number of people receiving unemployment benefits fell in early May to the lowest point in more than 50 years. After leaving the labor force in unusual numbers early in the pandemic.

Allianz Global Investors got hit with a huge ($5.8 billion) penalty for fraud and misrepresentation with respect to one of its institutional funds. Because the fund was shut down (the fraud was horrific), Allianz had to transfer $120 *billion* in AUM to VOYA.

Investing involves risk including the potential loss of principal. Consider your risks and objectives before investing. This is for informational purposes only and should not be construed as tax advice. Consult your tax advisor regarding your specific situation.

Securities and advisory services offered through Madison Avenue Securities, LLC, a Registered Investment Advisor, member FINRA and SIPC. Advisory services also offered through Wealth Management Institute, Inc., a Registered Investment Advisor. Wealth Management Institute and Madison Avenue Securities, LLC are not affiliated entities. Frank Cherniawski is securities registered in: AZ, CA, CT, FL, GA, IN, MI, MO, NC, OH, WA and Advisory Licensed in CA and MI with Madison Avenue Securities, LLC. Please inquire with the advisor about your state prior to further discussion or any decisions.