Electricity Inflation Nearly Double Core Inflation!

Electricity costs rose 15.8% in August from a year ago, the biggest jump since 1981, driven by higher prices for natural gas.

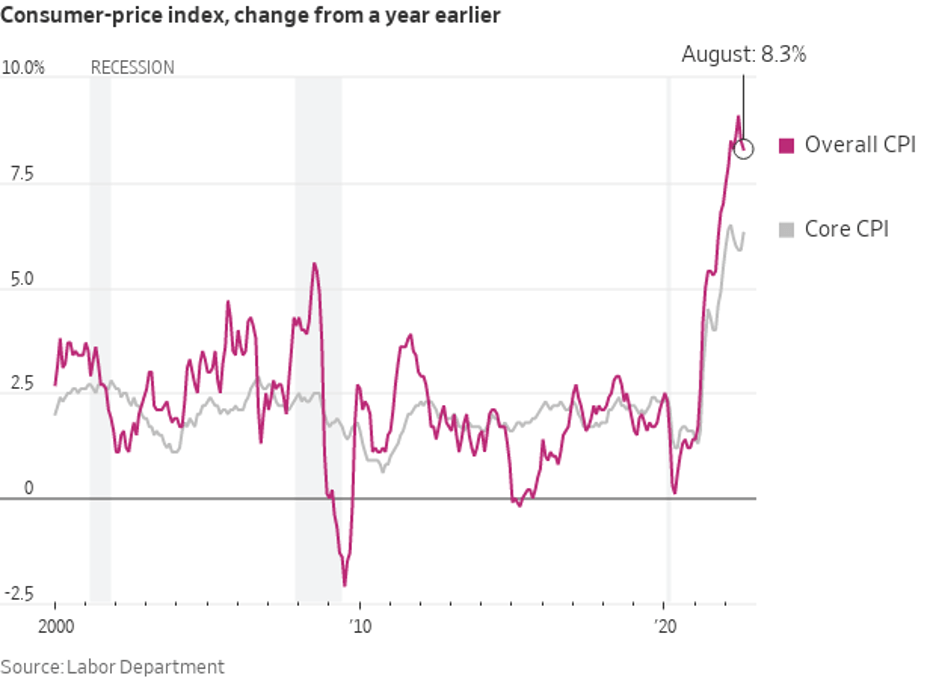

The annual rate of inflation decreased in August for a second consecutive month, from 8.5% to 8.3% measured by Consumer Price Index, The Bureau of Labor Statistics reported. That figure was driven largely by falling gas prices, however, which obscured alarming rates of inflation in other areas of the economy, like food, shelter, medical care, furniture, and cars and trucks.

Core inflation (which excludes the 5% drop in energy prices and 0.8% jump in food prices), increased at a 6.8% annual rate in August. The news all but ensured the Federal Reserve will continue aggressively hiking interest rates in the coming months, sending stocks tumbling.

The Dow Jones Industrial Average fell 3.94% in mid-September — the index’s worst day since June 2020.

The number of people filing new claims for unemployment benefits fell for the fifth straight week last week to 213,000 from 218,000 the previous week, an indication that the labor market remains strong even though other parts of the economy are weakening.

Mortgage rates hit 6.02% in mid-September, the highest level since 2008. That’s more than double where they stood a year ago, according to mortgage giant Freddie Mac.

Median household income was essentially unchanged at $70,800 last year after adjusting for inflation, according to the U.S. Census.

The poverty rate in 2021 was 11.6%, also unchanged from 2020. Roughly 37.9 million people lived in poverty last year. The poverty threshold for a four-person household last year was $27,740.

Deposits at U.S. banks fell by a record $370 billion in the second quarter as Federal Reserve rate increases are prompting investors to move money out of banks and into higher-yielding investments.

Investing involves risk including the potential loss of principal. Consider your risks and objectives before investing. This is for informational purposes only and should not be construed as tax advice. Consult your tax advisor regarding your specific situation.

Securities and advisory services offered through Madison Avenue Securities, LLC, a Registered Investment Advisor, member FINRA and SIPC. Advisory services also offered through Wealth Management Institute, Inc., a Registered Investment Advisor. Wealth Management Institute and Madison Avenue Securities, LLC are not affiliated entities. Frank Cherniawski is securities registered in: AZ, CA, CT, FL, GA, IN, MI, MO, NC, OH, WA and Advisory Licensed in CA and MI with Madison Avenue Securities, LLC. Please inquire with the advisor about your state prior to further discussion or any decisions.