Can The Feds Tame Inflation?

Domestic stocks moved sharply lower in late August as traders became less optimistic that the Federal Reserve will be able to tame inflation without causing a significant economic slowdown.

The Federal Reserve must continue raising interest rates and hold them at a higher level until it is confident inflation is under control even if unemployment rises, Chairman Jerome Powell said at a central bank retreat.

The second-quarter decline in U.S. economic output was less severe than initially estimated and unemployment claims fell slightly last week, signs of measured slowing in the overall economy in the face of high inflation and easing consumer demand.

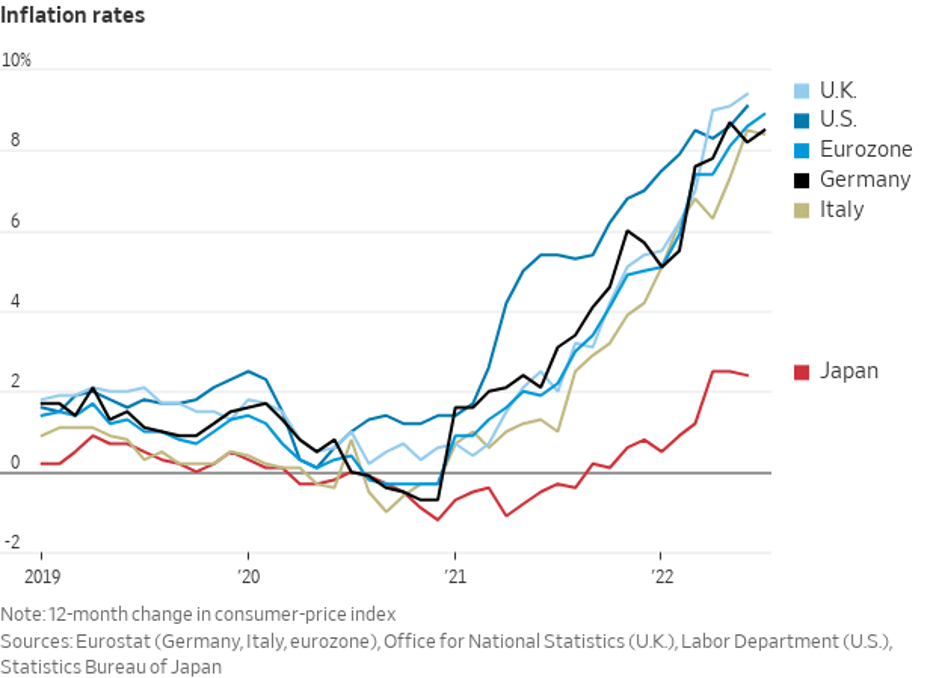

Business activity in the U.S., Europe, and Japan fell in August, according to new surveys, pointing to a sharp slowdown in global economic growth as higher prices weaken consumer demand and the war in Ukraine scrambles supply chains.

Mortgage rates jumped to the highest level since June, adding pressure to the fast-cooling housing market. The average rate on a 30-year fixed mortgage climbed to 5.55% in August, according to a Freddie Mac survey of lenders released Thursday.

The surprise in a faltering economy: Laid-off workers are quickly finding jobs.

A surplus of empty office space threatens to hollow out U.S. business districts.

Severe droughts across the Northern Hemisphere — stretching from the farms of California to waterways in Europe and China — are further snarling supply chains and driving up the prices of food and energy, adding pressure to a global trade system already under stress.

President Biden will forgive up to $20,000 in federal student loan debt for tens of millions of Americans, a move that will provide unprecedented relief for borrowers but is certain to draw legal challenges and political pushback.

Investing involves risk including the potential loss of principal. Consider your risks and objectives before investing. This is for informational purposes only and should not be construed as tax advice. Consult your tax advisor regarding your specific situation.

Securities and advisory services offered through Madison Avenue Securities, LLC, a Registered Investment Advisor, member FINRA and SIPC. Advisory services also offered through Wealth Management Institute, Inc., a Registered Investment Advisor. Wealth Management Institute and Madison Avenue Securities, LLC are not affiliated entities. Frank Cherniawski is securities registered in: AZ, CA, CT, FL, GA, IN, MI, MO, NC, OH, WA and Advisory Licensed in CA and MI with Madison Avenue Securities, LLC. Please inquire with the advisor about your state prior to further discussion or any decisions.