Closing at All-Time High's

Closing at All-Time High's

Closing at All-Time High’s

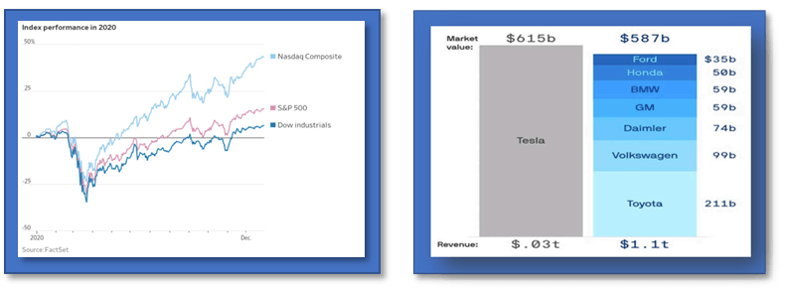

The major domestic equity indexes closed 2020 at All-Time Highs, however ended the week mixed as small-caps recording losses.

Stocks closed out a year of solid gains

led by the technology-heavy Nasdaq, notching its best annual performance since 2009.

Health care shares outperformed the S&P 500, and consumer discretionary shares were also strong, aided by gains in electric vehicle maker Tesla.

Stocks began the week on a positive note, helped by President Trump’s decision to capitulate and sign the $900 billion coronavirus relief bill

- The President repeated complaints the bill’s $600 payments to many Americans were insufficient, as well as his demand the bill include regulations on social media companies. House Democrat passed legislation to raise payments to $2,000, but Senate Majority Leader Mitch McConnell blocked it. No replacement bill emerged by the end of the trading week.

The UK became the first country to approve the use of the vaccine by AstraZeneca

and Oxford University, and hopes grew that U.S. regulators would soon follow.

- Slower-than-expected distribution of the Pfizer/BioNTech and Moderna vaccines may have dampened enthusiasm

- Case growth in the U.S. continued to moderate after the post-Thanksgiving spike, but an increase in hospitalizations raised concerns on intensive care unit capacity in some parts of the country.

Home prices rose faster than predicted in October, but November pending home sales unexpectedly fell 2.6 percent, reflecting constrained inventories.

Weekly jobless claims were expected to increase, but fell

to 787,000, the lowest level in almost a month.

New applications for unemployment assistance fell last week, a sign of modest improvement during a holiday period clouded with uncertainty around impending changes to benefit payments.

Home-price growth accelerated in October, as strong demand pushed home sales to a 14-year high.

Yield on 10-year U.S. Treasury note modestly lower, on fading likelihood of larger stimulus payments due to roadblocks in the Senate.

Shares in Europe rose, lifted by the UK-European Union (EU) trade accord and the approval of a U.S. fiscal stimulus package.

The Nikkei 225 closed

the week and the year just off the 30-year closing high.

China stocks moved to multiyear highs on the anticipation of stronger growth in 2021.

Source: "The Madison Weekly Market Wrap", January 2021.

Share

Tweet

Share

Mail

Contact Info

4710 W. Saginaw Hwy., Suite A

Lansing, MI 48917

517-323-2063

hmartin@wminstitute.com

Disclosures

Investing involves risk including the potential loss of principal. Consider your risks and objectives before investing. This is for informational purposes only and should not be construed as tax advice. Consult your tax advisor regarding your specific situation.

Securities and advisory services offered through Madison Avenue Securities, LLC, a Registered Investment Advisor, member FINRA and SIPC. Advisory services also offered through Wealth Management Institute, Inc., a Registered Investment Advisor. Wealth Management Institute and Madison Avenue Securities, LLC are not affiliated entities. Frank Cherniawski is securities registered in: AZ, CA, CT, FL, GA, IN, MI, MO, NC, OH, WA and Advisory Licensed in CA and MI with Madison Avenue Securities, LLC. Please inquire with the advisor about your state prior to further discussion or any decisions.

For Broker Check, click here

California Disclosures

Frank Cherniawski, Certified Financial Planner, is filed with the Commissioner and has not been disapproved. Personal state of domicile and principal place of business is Michigan. California Insurance License Number: 0B81627.

Privacy Policy

View Our Privacy Policy Here