2020 Hindsight

If you had fallen asleep on New Year’s Day 2020 and awakened one year later to look at market performance, you would have been incredibly pleased … and you would have missed the difficulty and the angst that was required to get to where we did.

On New Year’s Eve 2020 the bell tolled on one of the wildest years in Wall Street history, full of human tragedy, recession, massive job losses, precipitous plunges, remarkable rebounds, and record highs.

The S&P 500 returned more than 16% in 2020 , a result that seemed impossible in the bear-market days of March.

The Dow Jones Industrial Average and the Nasdaq gained 10% and 43%, respectively. The S&P and the Dow finished the year at all-time record levels despite a global pandemic, an economic crisis, and a contentious, disputed election.

As the global pandemic became clear back in March, stocks tumbled 34%. But it turned out to be the shortest bear market in U.S. history.

Since the market bottom on March 23, the S&P 500 gained 68% through year-end, shattering many

all-time records along the way. The S&P made 33 all-time highs in 2020.

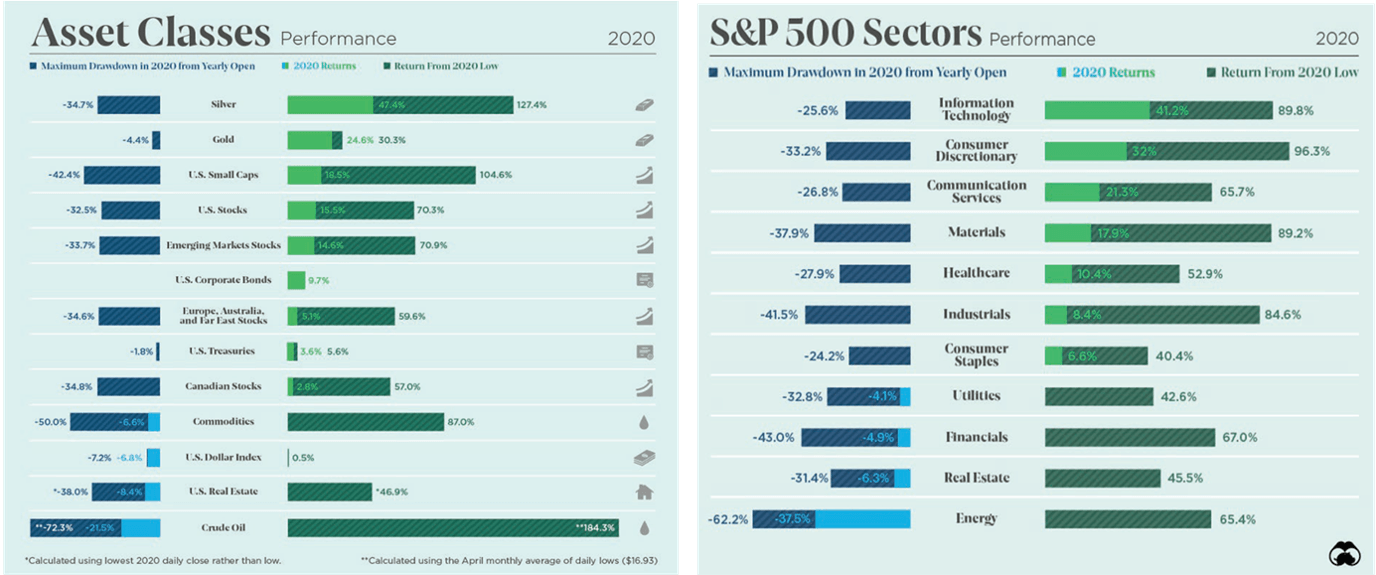

Within the S&P,

- Technology led the way (+41%)

- Consumer discretionary (+32%)

- Communications services (+21%)

- Materials (+18%)

- Only the energy sector was down for the year (-38%)

U.S. crude-oil prices are back near $50 a barrel after briefly dropping below $0 for the first time ever in April.

Overseas markets roughly correlated to their domestic counterparts as the pandemic was a global one.

- Japan (+14%)

- India (+16%)

- Germany (+12%)

- Brazil (-19%) suffered steep losses.

The final quarter of 2020 will primarily be remembered for the realization of at least three viable COVID-19 vaccines, a remarkable scientific achievement. Markets rallied on the prospect of an end to the global pandemic and its weighty economic impact.

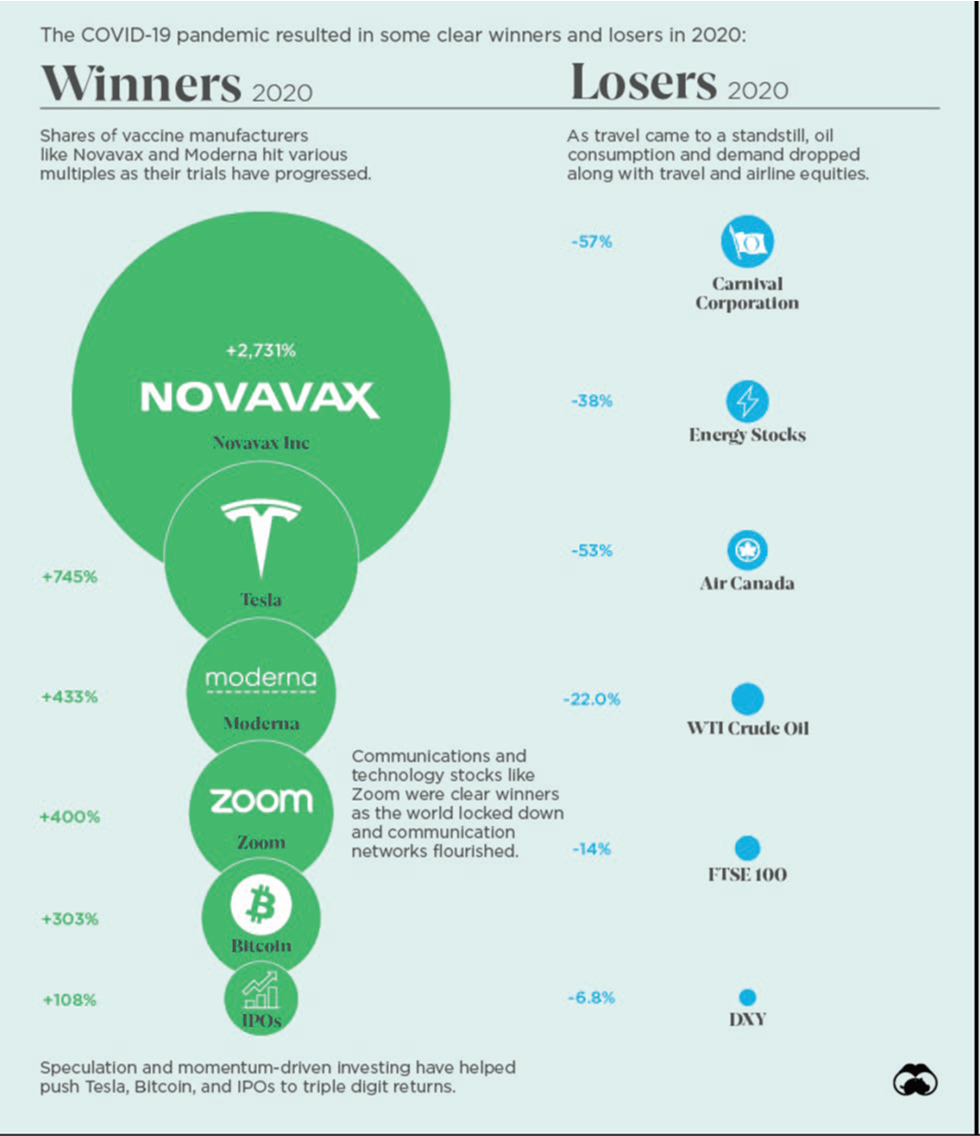

The market’s gains in 2020 were driven by a handful of superstar stocks.

Three of the biggest tech giants — Apple (+82%), Amazon (+76%), and Microsoft (+42%) accounted for more than half of the S&P 500’s return in 2020.

Absent the index’s top 24 companies, dominated by tech and digital services, the S&P 500’s return would have been negative for the year.

Tesla, the biggest gainer of the year (+743%), joined the S&P 500 late in 2020.

A once little-known biotech company (MRNA +433%); while the shares of first-to-market

vaccine-maker PFE barely moved, earning a paltry 1% for the year

A video conferencing company quickly became a staple of homeschooling, office meetings, and social gatherings Zoom Video Communications, ZM, returned 400%

China electric car maker, NIO, earned more than 1,100%

Gold posted its biggest annual advance in a decade – more than 25%

If you had been in cash at the market bottom in March and stayed there, you would have

missed out on a 68 percent return on the S&P 500 through year-end.

Source: “Madison Avenue 2021 Investment Outlook", January 2021.

Investing involves risk including the potential loss of principle. Consider your risk and personal situation before investing. It is not possible to invest in an index.