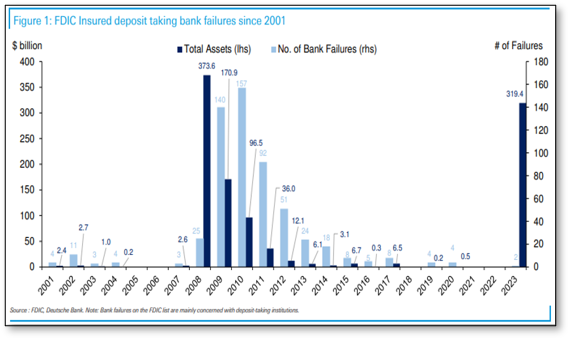

Worries of Bank Failures

Worries Silicon Valley Bank failure would set off a wave of new collapse have eased, despite the recent closure of another large regional, New York’s Signature Bank, which had heavy exposure to cryptocurrency markets. The Fed, the Federal Deposit Insurance Corporation, and the Treasury Department announced that all SVB depositors would have full access to funds the following morning, while the Fed made additional funding available to banks to safeguard deposits and prepared to address any potential liquidity pressures.

Eleven of the largest U.S. banks – Including JPMorgan Chase, Bank of America, Citigroup, and Wells Fargo – announced they were depositing a combined $30 billion in the San Francisco-based First Republic Bank in an effort to instill confidence in the nation’s mid-sized banks and assuage fears of a bank run like the one that caused Silicon Valley Bank.

Hopes that the Fed might adjust its monetary policy in response to events seemed to drive a rally.

Concerns that policy makers would reaccelerate the pace of rate hikes from 25 basis points to 50 basis points suddenly seemed off the table.

Recent news that European banking giant Credit Suisse was also experiencing problems sent markets sharply lower again, even though the Swiss bank’s problems were different in nature. Reports that the Swiss National Bank was planning to stabilize CS fostered a rally the following day.

Domestically, the struggles of California-based First Republic Bank, which had a focus on the tech sector like SVB’s – if not as extreme – also weighed on sentiment. After some initial uncertainty, traders appeared relieved by news that major banks had deposited $30 billion with First Republic to calm fears about its balance sheet.

Investing involves risk including the potential loss of principal. Consider your risks and objectives before investing. This is for informational purposes only and should not be construed as tax advice. Consult your tax advisor regarding your specific situation.

Securities and advisory services offered through Madison Avenue Securities, LLC, a Registered Investment Advisor, member FINRA and SIPC. Advisory services also offered through Wealth Management Institute, Inc., a Registered Investment Advisor. Wealth Management Institute and Madison Avenue Securities, LLC are not affiliated entities. Frank Cherniawski is securities registered in: AZ, CA, CT, FL, GA, IN, MI, MO, NC, OH, WA and Advisory Licensed in CA and MI with Madison Avenue Securities, LLC. Please inquire with the advisor about your state prior to further discussion or any decisions.