American's Finances Take a Hit as 60% Are Living Paycheck to Paycheck

Rising interest rates are hitting Americans’ finances. Indeed, 60% of Americans live paycheck-to-paycheck.

The Fed’s preferred inflation gauge, the personal-consumption expenditures price index, rose a seasonally adjusted 0.4% last month, largely reflecting energy costs.

Personal consumption, the main driver of the U.S. economy, rose an annualized 0.8% in the April-to-June period, according to the third estimate of gross domestic product from the U.S. Bureau of Economic Analysis. That compared with 1.7% in the previous estimate and marked the weakest advance in over a year.

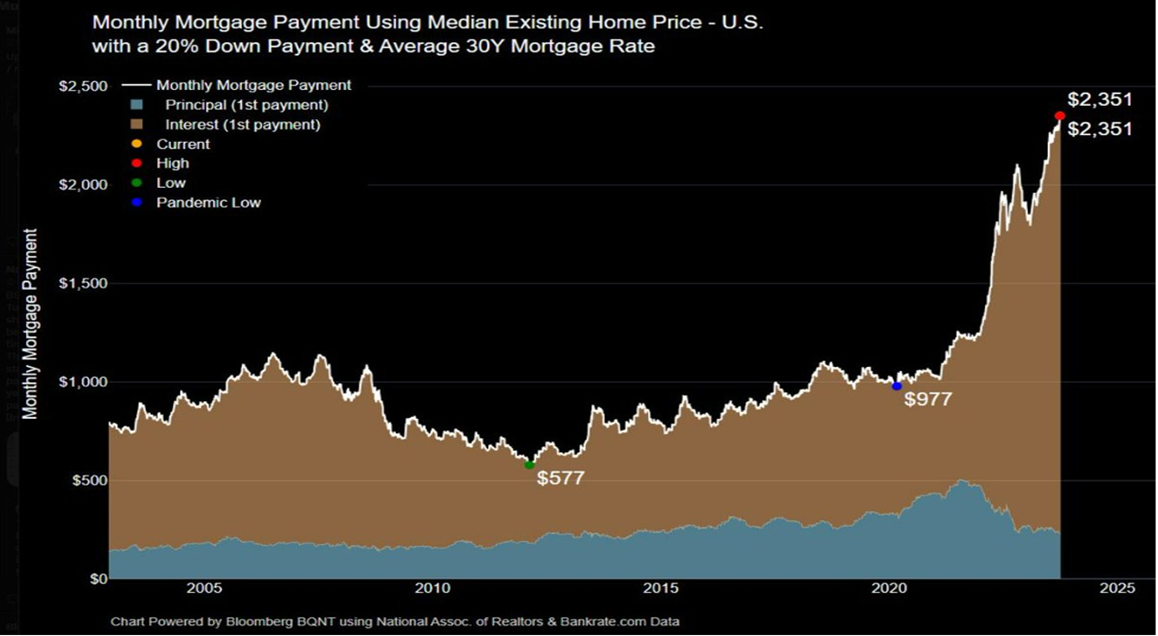

The average rate on the standard 30-year fixed mortgage jumped to 7.31%, mortgage-finance giant Freddie Mac announced, the highest level since December 2000. Mortgage rates have roughly doubled since early last year.

Sentiment among U.S. consumers weakened slightly in September, amid greater uncertainty about the direction of the economy.

Investing involves risk including the potential loss of principal. Consider your risks and objectives before investing. This is for informational purposes only and should not be construed as tax advice. Consult your tax advisor regarding your specific situation.

Securities and advisory services offered through Madison Avenue Securities, LLC, a Registered Investment Advisor, member FINRA and SIPC. Advisory services also offered through Wealth Management Institute, Inc., a Registered Investment Advisor. Wealth Management Institute and Madison Avenue Securities, LLC are not affiliated entities. Frank Cherniawski is securities registered in: AZ, CA, CT, FL, GA, IN, MI, MO, NC, OH, WA and Advisory Licensed in CA and MI with Madison Avenue Securities, LLC. Please inquire with the advisor about your state prior to further discussion or any decisions.